Last but certainly not least, let’s talk about Free Trade Zones (FTZs) and how they can supercharge your cashflow. Traditional duty drawbacks, where you recover customs duties and taxes paid on imported goods, can be a slow and cumbersome process. Your money remains tied up until you receive the reimbursement, affecting your cashflow.

However, by operating within a Free Trade Zone, you can defer the payment of customs duties and taxes until your products are withdrawn from the zone for U.S. consumption. This means that your working capital is no longer held hostage by customs duties, freeing up your cash for more critical business needs.

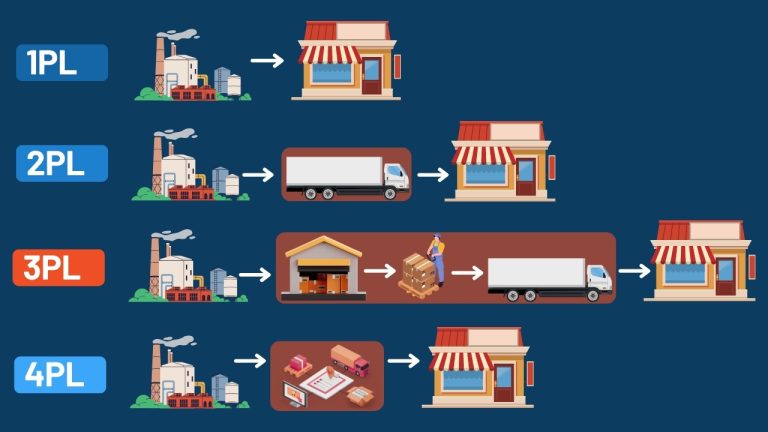

The FTZ advantage extends beyond cashflow. It simplifies your logistics and ensures that your products are strategically positioned for efficient distribution. Combined with the benefits of Section 321 and outsourcing to a Canadian 3PL, it creates a trifecta of advantages that significantly improve your profit margins and cashflow.